In the high-stakes world of live events, “trust but verify” has become a mantra for venue operators. Handing your stage over to an outside promoter or private client can bring in fresh audiences and revenue – if you choose wisely. Without proper vetting, however, a bad event partner can leave your venue with empty seats, unpaid bills, or even a tarnished reputation. This guide provides a practical, step-by-step approach to due diligence in 2026, informed by veteran venue managers who have seen it all – from stunning successes to cautionary tales of partnerships gone wrong.

Why Vetting Promoters & Clients Is Critical

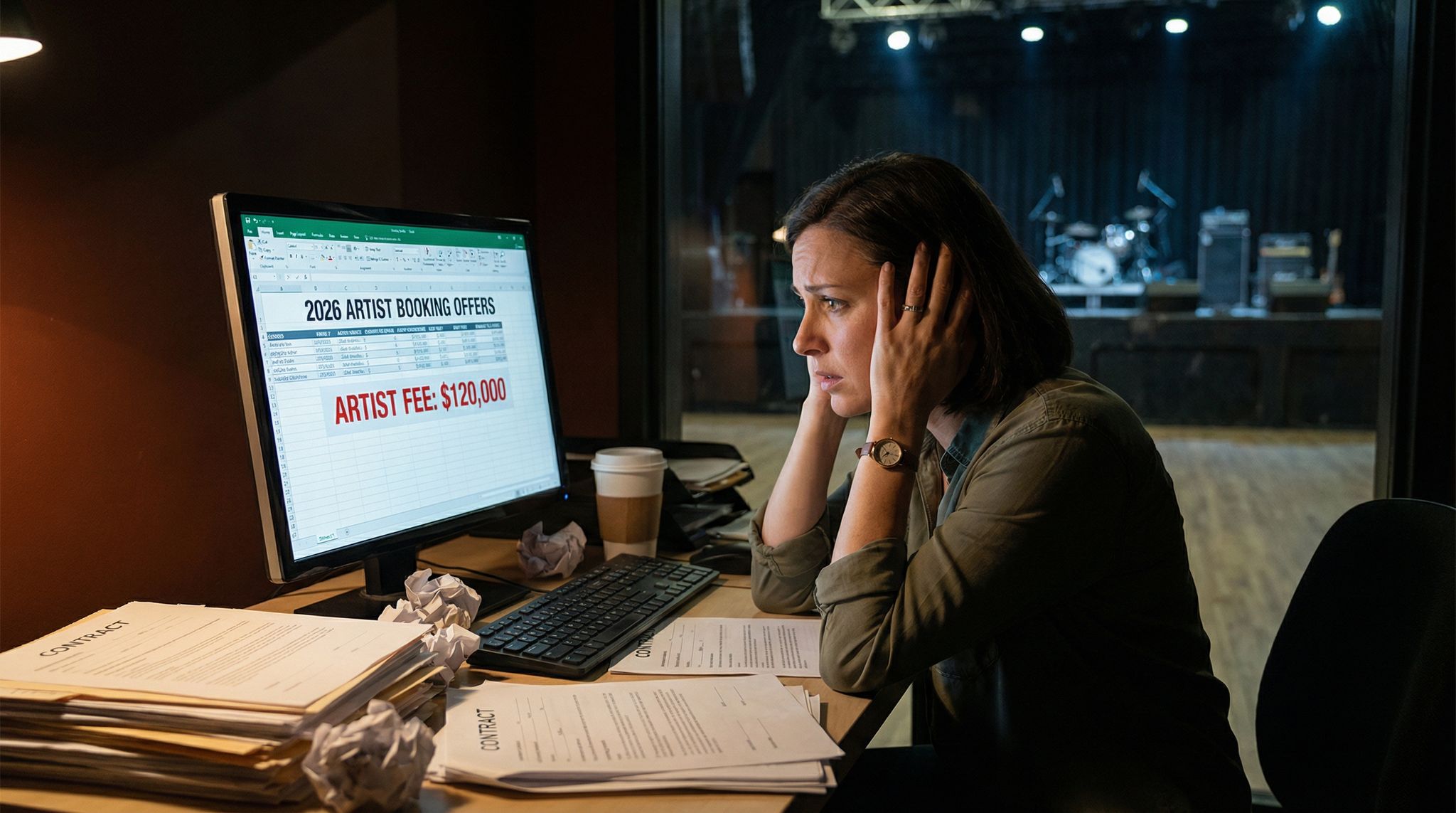

The Stakes: Booking an unvetted event can spell disaster. Imagine a scenario where an outside promoter promises a packed house, but come showtime your venue is nearly empty because their marketing fell flat. Or worse, the promoter vanishes without paying outstanding balances, leaving you to cover production and staff costs. Industry veterans emphasize that these nightmares are avoidable through rigorous vetting. In an era where live events are bouncing back (and new promoters are popping up everywhere), due diligence is your first line of defense. Even a single problematic event can mean significant financial loss and damage to your venue’s hard-earned reputation.

Real-world cautionary tales illustrate the importance of verification. The infamous Fyre Festival fiasco of 2017, for example, became a textbook case of what happens when event vetting fails – local partners and vendors were left unpaid as organizers faced fraud lawsuits, a situation detailed in Time Magazine’s coverage of the Fyre Festival lawsuit. While that was an extreme example, seasoned venue operators worldwide have their own stories: a “promoter” who rented a club for a night and oversold tickets beyond safe capacity, a private event client who canceled last-minute leaving the venue dark on a prime date, or a touring show where the promoter failed to pay the artist, causing an on-site showdown. The lesson is clear – never hand over your stage without knowing exactly who you’re dealing with and having safeguards in place.

From independent clubs to municipally-owned theatres, the consensus in 2026 is that proactive vetting is non-negotiable. As one veteran venue manager put it, “Don’t wait to learn a promoter’s true colors when the house lights go down.” Due diligence not only averts disasters but also sets up partnerships for success by ensuring both sides are qualified and prepared. In the sections below, we’ll break down how to conduct comprehensive background checks, financial verification, insurance and safety reviews, and contract safeguards before you commit to any outside event. By following these steps, you can confidently embrace new promoters and clients to fill your calendar – without gambling your venue’s finances or good name.

Check the Track Record: Research Reputation & History

The first step in vetting any promoter or event client is to thoroughly research their track record. Experienced venue operators know that past behavior is one of the best predictors of future performance. Before you say “yes” to an outside event, dig into the promoter’s history:

- Past Events: Request a list of significant events the promoter or client has run, including dates, venues, and artists or event themes. Then, verify those events independently. Look for evidence that those shows actually took place and were successful – for example, press coverage, social media posts, or listings on reputable sites. If a promoter claims they sold out a 1,000-capacity hall last year, you should be able to find some trace of it online or via industry contacts. No news or a thin history is a red flag.

- Reputation in the Industry: Tap into the live events grapevine. In this business, reputation travels fast. Reach out to fellow venue managers through professional networks or associations. Many venues (especially within the same city or region) informally share intel on reliable and unreliable promoters. If you’re part of a venue alliance or association, use those connections – one call could reveal if a promoter consistently comes up short. According to venue alliances in 2026, collaborating and sharing information has become a key survival strategy, as noted in guides on venue promoter agreements which emphasize ensuring the venue is proper for the event. Don’t hesitate to ask around about a new promoter’s professionalism, ability to draw a crowd, and history of paying bills on time.

- Online Footprint: Investigate the promoter’s online presence. A credible promoter or event organizer should have some combination of a website, Facebook/Instagram page, YouTube videos of past events, or listings on ticketing sites. Look at their follower engagement and the feedback from attendees or artists. Consistently good reviews and solid content indicate a professional operation, whereas a lack of online information or a page filled with complaints can be telling. Also perform a news search for the promoter’s name or company – check for any headlines about canceled events, lawsuits, or disputes. Even a quick scan can uncover, for instance, if they left another venue with unpaid invoices or oversold a show and caused safety issues.

Verify References and Credibility

A trustworthy promoter or client will understand your need to verify their credibility and should willingly provide references. Ask for references from at least two venues or artists they’ve worked with recently. Then actually follow up on those references – this is where many venue managers drop the ball. A 10-minute call with another venue owner could save you from a costly mistake. When speaking to a reference, have a few pointed questions ready:

- Did the promoter fulfill their promises (e.g. draw the expected crowd, run the show smoothly)?

- Were there any issues with payment or professionalism?

- Would you work with them again?

Listen not just for the words, but the tone. Hesitation or lukewarm feedback speaks volumes. As one veteran venue operator noted, “If a previous venue wouldn’t eagerly welcome them back, think twice.” Also, verify the basics: ensure the promoter’s business is properly registered (a quick corporate registry search in your country can confirm if their company exists and if it’s in good standing). If they’re an individual, see if they’ve been active under other business names. Scam promoters often change names to dodge bad reputations.

Be wary of newcomers with big promises. Everyone has to start somewhere, but an inexperienced promoter shouldn’t start with your biggest Saturday of the year. One venue learned this the hard way: they gave a prime Saturday night to an enthusiastic new promoter who claimed to have “amazing acts and a huge social media following.” The result? The lineup was mostly unknown bands and marketing was sparse – only a handful of people showed up to a space that could hold a few hundred. Not only was it disappointing (and a financial loss for the promoter), it was a missed opportunity for the venue, who could have booked a proven event that night. This scenario highlights the importance of vetting the credentials of new promoters and prioritizing experience rather than a one-time promise. The lesson, echoed by seasoned managers, is vet credentials and start small: consider testing new promoters on a weeknight or a smaller room first, letting them prove themselves before handing over a packed weekend slot. By initially booking them on off-peak nights, you minimize risk while giving them a chance to build a track record. If they balk at a smaller opportunity, that itself is a warning sign – reputable newcomers understand the need to earn trust.

In short, do your homework. A promoter with a solid track record will be happy to have you verify their success – they may even have press clippings or testimonials at the ready. It’s the ones who get defensive or evasive about their history that you should approach with extreme caution. As the saying goes, “reputation is everything” in entertainment. A little detective work up front can distinguish the next great event partner from a potential problem.

Show Me the Money: Deposits, Payments & Financial Due Diligence

Once you’re comfortable with a promoter’s background, it’s time to verify their financial reliability. Venues that have been burned in the past will tell you: a promoter’s plans mean nothing if they don’t have the funds to execute them. Financial due diligence protects your venue from no-shows, last-minute cancellations, and unpaid bills. Here’s how to ensure your event partners have skin in the game and the ability to pay their obligations.

Require Meaningful Deposits

Upfront deposits are standard practice for good reason – they separate serious organizers from risky opportunists. By 2026, most venues worldwide require a deposit to secure a date, often 50% of the rental or expected fees, due upon signing the agreement. For example, an independent theatre in Los Angeles might require a 50% deposit (say, $5,000 on a $10k rental) to lock in a concert date, with the balance due a few weeks before the show. Smaller venues or private event bookings (like weddings) may even ask for the full fee in advance, or split it into a schedule (e.g. 50% on booking, 50% by 14 days out). The key is that the promoter/client has made a real investment upfront. A deposit accomplishes several things:

- It provides immediate compensation to the venue for holding the date (which has opportunity cost).

- It signals the promoter’s commitment and financial capability. If they struggle to produce a deposit, how will they cover advertising or artist payments?

- It gives you leverage; if the event is canceled by the promoter, you may keep the deposit (fully or partially, depending on contract terms) to offset lost income.

Set deposit policies in writing and stick to them uniformly. Veteran venue managers advise against making exceptions for sob stories or “we’ll pay you after the ticket sales” promises – that’s a slippery slope. One mid-size venue in Sydney learned this when they bent their rules for a new club night promoter who was “waiting for investor funds.” They accepted just 10% down. Predictably, the event’s turnout was poor, the promoter lost money, and then failed to pay the remaining rent, leaving the venue in a lengthy collections battle. Now that venue’s policy is ironclad: no deposit, no booking.

Ready to Sell Tickets?

Create professional event pages with built-in payment processing, marketing tools, and real-time analytics.

Consider scaling deposit amounts to the risk profile of the event. For multi-date holds or high-cost events, you might require a larger percentage or staggered payments (e.g. 25% to hold the date, another 25% at a production benchmark, etc.). Always specify deadlines for final payment well before the event (commonly the balance is due 7-30 days prior). That way, if payment doesn’t arrive, you have the right to cancel the event before you’ve incurred all the show expenses. It’s far easier to re-fill a date a month out than to deal with a non-paying promoter on show day.

| Event Type / Size | Upfront Deposit Required | Insurance Requirement (Liability) |

|---|---|---|

| Small local promoter night (200–300 cap club) | 25–50% of venue fee (e.g. £500 on a £1,000 hire) due on signing | £1–2M Public Liability Insurance, venue named as additional insured |

| Mid-size concert (500–1,500 cap) | 50% of rental + estimated expenses (due 30 days prior) | $2M USD general liability minimum; liquor liability if alcohol is served |

| Large concert or festival (5,000+ attendance) | 50% deposit + bank guarantee or letter of credit for balance | $5M+ general liability; event cancellation insurance recommended |

| Private corporate event | 50% on booking, 50% by 14 days out (or full fee upfront) | Company’s insurance to cover event; $1–2M liability coverage typical |

| Private social event (e.g. wedding) | 50% deposit, balance by 30 days out; plus refundable damage deposit (e.g. €1,000) | One-day event insurance policy if required by venue (liability cover €1M+ depending on venue) |

Examples of common requirements in 2026. Always adjust for local currency and regulations. Larger or higher-risk events warrant higher coverage and more stringent payment terms.

Verify Budget and Financial Backing

A deposit is just the first financial check. You also want confidence that the promoter can fund the event’s other critical expenses – artists, production, marketing, staffing, etc. Many venues now ask outside promoters for a basic event budget during the proposal stage. This isn’t to micro-manage their spending, but to quickly identify if any important line item is grossly underestimated or missing. For instance, if a promoter is planning a 1,000-cap dance night and only budgeting $200 for security, you know there’s a problem. Reviewing a budget with them allows you to flag such issues and insist they’re addressed (e.g. “We recommend at least 8 security staff for that crowd, which will cost approx $1,600”). If the promoter balks at the necessary spend, it indicates they might cut corners – or that they’re in over their head financially.

Some veteran venue operators take it a step further and run a credit check or ask for financial references for new promoters undertaking major events. This is more common for large-scale rentals like festivals, multi-day conventions, or any event where the promoter is a newly formed company with limited track record. You might request a bank reference letter or evidence of event cancellation insurance (which implies they have underwriters reviewing their plan too). In certain cases, venues have even asked to see proof that the promoter paid the artist deposit (for high-profile concerts) – no artist deposit, no venue contract. While not every situation calls for such measures, the underlying principle is to confirm the promoter has the financial stability to deliver what they promise.

Also, clarify how ticket revenue will be handled. If the deal involves a share of ticket sales or a rent versus gross receipts model, insist on transparency. One reliable method is to use your venue’s ticketing platform or a mutually agreed ticketing service that escrows the funds and provides both parties real-time access to sales data. Many venues prefer to sell tickets in-house even for outside-promoted shows, precisely so they can track sales and ensure the settlement will be covered. An illustrative example comes from an Australian venue that allowed a promoter to use their own ticketing system for a series of shows; the events sold well, but the venue never saw the customer data and had to trust the promoter’s accounting for the ticket split. The following year, that promoter took the same tour to a different venue, taking all the fan data with them and leaving the original venue unable to market to those attendees. It is crucial to beware of the data ownership trap by establishing agreements or at least joint data access. The venue lost out on repeat business partly because they hadn’t negotiated data sharing or control of ticketing. The moral: retain control over ticketing and data whenever possible. If a promoter insists on an external system, negotiate administrative access or at least joint ownership of the attendee list. And absolutely ensure that your share of funds will be settled through a trustworthy process (for example, the funds might go into an escrow account that releases your portion to you directly). Modern event platforms like Ticket Fairy can facilitate such arrangements, giving both venue and promoter transparency and protecting against box office fraud. The added benefit is you maintain access to attendee information for future marketing – an important asset in 2026’s data-driven marketing landscape.

Finally, protect your downside. Even with deposits and good sales, have a plan if the event underperforms. If you’ve negotiated a minimum guarantee (e.g. the promoter pays you the higher of $X or 10% of ticket sales), be sure you actually collect that minimum regardless of ticket sales. If tickets are being sold through a system you control, you can deduct your minimum or expenses directly before passing through the rest to the promoter. The contract section (coming up) will cover legal safety nets in detail, but from a financial perspective, ensure you’re never left holding the bag for someone else’s shortfall. As one finance-savvy venue owner bluntly puts it, “Hope for the best, plan for the worst, and get the money in writing.”

Grow Your Events

Leverage referral marketing, social sharing incentives, and audience insights to sell more tickets.

Cover Your Bases: Insurance, Permits & Safety Compliance

Even if a promoter checks out on paper and financially, your vetting must extend to safety and compliance. Ultimately, anything that happens under your roof (or on your grounds) will reflect on your venue – and you could be held liable if proper precautions aren’t in place. That’s why top venue operators insist on two things before any outside event: adequate insurance coverage and a clear safety plan. These requirements protect your venue’s people, property, and licenses.

Insist on Insurance and Legal Compliance

One of the first questions to ask an external promoter or client is: “Do you have insurance for your event?” If the answer is no (or confusion), make it clear that event liability insurance is mandatory. Virtually all professional venues in 2026 require outside event organizers to carry Public Liability Insurance (PLI) or general liability insurance, with coverage amounts scaled to the event size. A small 200-person gig might require a $1 million USD (or £1m in the UK, A$1.5m in Australia, etc.) liability policy, whereas a large concert could require $5 million or more. The promoter should provide a Certificate of Insurance naming your venue (and any associated entities, like the venue owner or city, if applicable) as “additional insured” for the date of the event. This means their policy covers claims against your venue arising from the event. Do not accept an event without proof of insurance in hand well before show day. If they are a one-off client who doesn’t have a policy, refer them to event insurance providers – one can obtain short-term event coverage relatively quickly. Skipping insurance is simply too high-risk; as one risk manager quips, “If they won’t insure it, you shouldn’t host it.”

Keep in mind different types of insurance that might be relevant:

- General Liability – covering bodily injury or property damage claims by attendees, crew, etc. This is the core insurance every event needs. In many places, it’s not legally required by law for an event, but venues are wise to require it contractually, aligning with standard event safety insurance guidelines.

- Liquor Liability – if alcohol is served and the promoter is handling the bar or bringing alcohol, ensure there’s liquor liability coverage (or that it falls under your own if you run the bar, but then adjust the deal accordingly). Some general liability policies include host liquor liability, but verify if coverage is sufficient per local law.

- Worker’s Compensation – if the promoter is bringing in their own labor (stagehands, technicians), check jurisdictional requirements. In the US for example, if they have employees working the event, they should have worker’s comp insurance. In other countries, ensure all their staff/contractors are insured for injuries.

- Property/Equipment Insurance – if they’re loading in expensive gear or installing decor, you might require proof of property insurance or that your venue insurance is extended to cover those items (often the promoter will be responsible for insuring any equipment they bring). Also, if there’s a high risk of damage to your venue (say a motorsports stunt show inside an arena), consider a higher damage deposit and confirmation that their insurance covers property damage to the venue.

- Event Cancellation insurance – not required by venues typically, but if a promoter has it, that’s a good sign of professionalism. It means if unforeseen events (e.g. severe weather, key performer illness) force a cancelation, there’s an insurance policy that can cover certain financial losses. This can indirectly protect you (e.g. if the promoter can recoup costs, they’re less likely to default on payments to you). You may not insist on it, but it’s worth discussing for larger events.

Don’t just collect the certificate – verify it. Ensure the policy dates cover the event (and ideally load-in/load-out days) and that the coverage amount meets your venue’s minimum requirement. Check the named insured (it should match the promoter’s legal entity or personal name) and that your venue is correctly listed as additional insured. If anything looks off, have them get it fixed before signing the contract or definitely before event day. Some venues even require receiving the insurance certificate at least 30 days prior to the event; if a promoter hasn’t produced it by the deadline, that’s grounds to cancel the booking and keep the deposit (again, as long as your contract spells that out). This may sound strict, but experienced venue owners will tell you that legitimate promoters are used to this process – they won’t be surprised or insulted when you ask for proof of insurance, it’s standard practice. It’s often the inexperienced or dodgy operators who push back or delay providing a certificate, and that’s a red flag not to ignore.

Beyond insurance, enforce all permit and legal requirements relevant to the event. Make sure the promoter is aware of local regulations – and ideally, make it their responsibility (in the contract) to obtain any necessary permits or licenses, with your oversight. Common examples:

- Capacity and Fire Safety: Ensure they know your legal capacity and will not attempt to exceed it. If they’re selling tickets, cap it at your approved number (and factor in comps in that count). If they suggest a “guest list at the door” beyond the sold tickets, be very cautious – you’re the one who faces penalties if capacity is breached. Coordinate with them on ticket counts. Some venues include in contracts that the venue reserves the right to halt admissions if capacity is reached (regardless of what the promoter sold).

- Noise Curfews: If your city or local authority has a noise ordinance or curfew for amplified sound, the promoter’s event must comply. Make this clear from the outset: for instance, outdoor show curfew at 10:00 PM, or indoor sound curfew at 11:00 PM if applicable. If they plan a DJ afterparty or extended encores that break curfew, they need to adjust plans or secure a special permit (rarely given, but if so, get it in writing from the authorities). Many venues have faced hefty fines and angry neighbors due to curfew violations, and you don’t want your venue on that list. You can even bake in a clause that any fines incurred from curfew violations by the promoter will be paid by the promoter – a strong deterrent for them to respect the cut-off time.

- Licensing (Alcohol, etc.): Determine who is handling alcohol sales or service. If it’s your venue bar, ensure the event aligns with your licensing (e.g. if it’s a teen event, you might restrict alcohol entirely). If the promoter is allowed to run their own bar (less common, but sometimes in private rentals), then they must have the proper temporary liquor license and trained servers per local law. Never allow an unlicensed or informal “BYO bar” – it could get your venue’s licence in jeopardy. The same goes for any other licenses (for example, some places require a dance hall license, special event license for public events, etc.). Guide the promoter on what’s needed, but hold them accountable for securing it, or have them cover the fees if you apply on their behalf.

- Security and Medical: Check if local law or policy requires a certain number of security personnel or even on-site EMTs for larger crowds. As the venue, you might arrange these services (and charge the promoter), or you might allow the promoter to hire an approved security company. Either way, confirm that the security plan meets any regulatory requirements (some cities set guard-to-patron ratios). Your venue’s own safety standards should apply as well – for instance, you may insist on bag checks or metal detectors for certain events. Communicate these expectations early. A promoter who resists standard security measures to save money is not someone you want in your space; any compromise on safety is a deal-breaker.

- Emergency Plans: While typically the venue’s domain, make sure the promoter and their team are looped into your emergency protocols. In vetting discussions, ask if they’ve ever had to handle an evacuation or major incident, and what their approach was. If they look puzzled, that’s a sign you’ll need to firmly take the lead on safety (or possibly reconsider the booking if the event inherently carries higher risks). At minimum, plan an advance briefing where you walk them through emergency exit locations, crowd management procedures, and who has authority to stop the show if needed. Some veteran operators will explicitly write into agreements that the venue’s duty manager or chief of security has the right to pause or cancel the event if they deem conditions unsafe (crowd crush risk, fire alarm, structural issue, etc.). It’s rare to invoke, but important to have in writing. Recent festival disasters and venue incidents show that acting quickly at signs of danger is crucial – you need promoters who will cooperate, not argue, in an emergency.

The bottom line is cover all angles of safety and compliance during vetting. A promoter who has their act together will come prepared with evidence of insurance, awareness of local rules, and a cooperative stance on safety planning. On the other hand, if you encounter responses like “Do we really need security for 500 people?” or “We’ll figure out the permits later,” it’s time to either enforce strict conditions or reconsider the deal. Protecting your venue means ensuring every event follows the law and best practices – no exceptions, no excuses. Your venue’s licenses (and more importantly, people’s well-being) depend on it.

The Golden Contract: Setting Terms & Expectations in Writing

After doing all the background work – checking reputations, confirming finances, and ensuring compliance – the final safeguard is a solid contract. A well-crafted agreement cements everything you’ve discussed and provides legal recourse if things go wrong. Seasoned venue operators often say that a good contract forces the tough conversations up front – if a promoter hesitates to sign clear terms on paper, that’s a red flag you can’t afford to ignore. Here’s what to include and how to set crystal-clear expectations.

Outline Roles and Responsibilities

One cause of conflict between venues and outside promoters is assumptions over who handles what. Never leave responsibilities to assumption. Your contract (and the earlier conversations) should spell out each party’s duties in detail. Key areas to delineate include:

- Marketing & Ticket Sales: Decide who is responsible for marketing the event (likely the promoter, but your venue might contribute on your socials or venue email list). Clarify if the promoter is expected to spend a minimum on advertising or if you’ll do any co-promotion. Also, put in writing which ticketing platform will be used and who manages ticket sales. If it’s your venue’s ticketing system, note any service fee splits or ticket holds for the promoter. If it’s an external system by the promoter, ensure you still get access to sales reports and payout details. Miscommunication here can be costly, so set these expectations early. As industry veterans note, clear agreements about who handles marketing and ticketing can make or break a promoter partnership – everyone needs to know their lane.

- Venue Services & Staffing: List what your venue will provide (e.g. in-house PA system, lighting, X number of security staff, front-of-house managers, cleaning crew) and what the promoter is expected to provide or pay for. If you’re including staffing or equipment in the rental fee, specify it. For any additional services (coat check staff, additional barricades, etc.), clarify the cost or that the promoter must arrange them with your approval. Surprises on show day (“We thought you were providing the drum kit!”) are a sign of poor advance communication. Don’t let that happen – itemize everything from technical gear to hospitality staffing in the agreement or attached riders.

- Production & Technical Needs: Ideally, attach the artist’s rider or event technical rider to the contract as a reference, so it’s clear what’s needed. State who is responsible for fulfilling each item. For example, if the promoter is bringing an artist with a huge LED wall requirement, are they renting that or is the venue expected to coordinate rental at the promoter’s expense? If you have an in-house production team, will the promoter be required to use them (common in union venues or venues with exclusive crew)? If so, outline the labor costs or that you’ll provide a quote in advance. No one likes surprise bills – make it transparent.

- Scheduling & Run of Show: Note the expected timeline – load-in start, soundcheck windows, door time, show start, curfew, load-out end. While this might also live in a production advance document, having key timing (like curfew) in the contract is wise. It cements that, for instance, “All live music will end by 23:00 to comply with local noise ordinances,” which gives you the right to enforce that on the day. If the promoter needs extra time (for example, an extended load-out into the next morning), define whether that incurs extra fees. Essentially, define the access period the rental covers.

- Hospitality & Backstage: If your venue provides in-house catering or sells backstage hospitality packages, clarify that. Otherwise, if the promoter handles artist hospitality, set any rules (like no alcohol in green rooms unless provided by licensed caterer, etc., for legal compliance). If you have policies on guests or backstage access (many venues require adherence to capacity limits in green rooms, or have rules about pyrotechnics, open flames, etc.), include those in an addendum or rider that the promoter signs off on.

- Cleaning/Damages: State whether cleaning is included or if an excessive mess will incur a fee. Always have a clause that the promoter/client is responsible for any damage to the venue beyond normal wear and tear. Sometimes venues take a separate damage deposit especially for private events or high-risk gigs (refundable after if no damage) – if you do this, it should be noted in the contract along with the amount and conditions for refund.

Spelling out these responsibilities may feel tedious, but it pays off. Veteran venue managers use comprehensive checklists (often covered in an advance meeting) to ensure nothing falls through the cracks and that agreed terms protect the venue. A common refrain is: “If it’s not in writing, it doesn’t exist.” Both parties should review and agree to every detail well before the event. This level of clarity not only prevents day-of disputes but also signals to the promoter that your venue runs a tight ship – if they are disorganized or had any thought of winging it, this process sets a professional tone.

Pro Tip: Communication is part of vetting

How a promoter handles the pre-event coordination is very telling. Pay attention to their responsiveness and organization during the booking and contracting phase. Do they answer emails and calls in a timely manner? Do they provide needed information (like schedules, artwork for marketing, insurance docs) without constant chasing? If they are chronically slow or disorganized now, it may only get worse under the pressure of event day. Many experienced venue operators will privately admit that they “audition” promoters during the planning phase – if someone fails to communicate or follow through on small tasks, they likely won’t get a repeat booking, no matter how well the event itself might draw. In short, professional communication is part of the vetting criteria. It builds trust on both sides.

Must-Have Clauses to Protect Your Venue

A strong contract isn’t just about listing duties – it should also protect your venue if the promoter doesn’t hold up their end. Here are some key clauses and terms to include (many of these align with standard venue agreements, but double check with your legal advisor to tailor them to your locale and operation):

- Payment Terms & Default: Clearly state the total fee or rent, any percentage of ticket sales or additional charges, and the schedule of payments (deposit and balance due dates). Specify that failure to pay on time may result in cancellation of the event and retention of any deposits paid. You want the ability to terminate the agreement if the promoter misses a major payment milestone – otherwise you could be stuck in limbo. Also detail how any overages will be handled (e.g. if additional costs are incurred, how soon after the event they must settle – typically immediately or within a few days at most, and often taken out of the ticket settlement).

- Cancellation and Refunds: Define what happens if the promoter or client cancels the event. For example: Cancellation more than 60 days out = full refund of deposit minus an admin fee; cancellation 30-60 days out = forfeit 50% of deposit; cancellation under 30 days = forfeit 100% of deposit, etc. This is crucial to ensure you’re compensated for holding the date and lost opportunities. If you, the venue, must cancel (e.g. due to a venue issue or emergency), outline how deposits are returned or if you offer an alternate date, etc. Make sure it’s clear that if the event is canceled due to promoter’s breach of contract (like not providing insurance or missing payments), that’s considered a promoter cancellation (hence your right to keep deposit or seek damages).

- Indemnification and Liability: Include a mutual indemnification clause where the promoter agrees to indemnify (protect and defend) the venue against any claims or losses arising from the promoter’s event, except those due to the venue’s own negligence. Essentially, if the promoter or their attendees do something that causes a lawsuit or damage, the promoter covers it. Many contract templates have the legal language for this. Also consider a limitation of liability clause – for instance, the venue isn’t liable for promoter’s lost profits or consequential damages if the event doesn’t happen (common with force majeure, etc.). Legal experts advise using mutual but reasonable indemnities, and caution that blanket one-sided indemnities might be unenforceable, so get proper wording here.

- Force Majeure: As the pandemic taught us, force majeure (unforeseen major events like natural disasters, government shutdowns, etc.) can wreck plans. This clause says neither party is liable if the event can’t occur due to causes beyond their control (often list examples: acts of God, war, epidemic, government order, etc.). However, pay attention to how it’s worded in terms of refunds or rescheduling. Ideally, if force majeure happens, you might agree to reschedule the event at a mutually workable date, or if not possible, you refund the promoter’s deposit minus any expenses incurred. The promoter shouldn’t hold you responsible for their other losses if a hurricane hits, and vice versa, a concept central to the Force Majeure provisions of a venue promoter agreement. Post-2020, many contracts got very specific here (e.g. including “pandemic” as a defined force majeure). Make sure this clause is up-to-date and clear on the outcomes.

- Act of God / Event Cancellation by Artist: If the promoter’s event hinges on a specific performer (like a concert with a headlining artist), consider a clause addressing that scenario. Often it’s on the promoter to handle – e.g., if the artist cancels, the promoter is still on the hook to either find a comparable replacement or cancel per the normal terms. You might allow a one-time date move if the schedule allows, but don’t assume; put it in writing. This protects you from a situation where an artist no-show leads the promoter to bail without covering your costs. (Many promoters will insure against major artist no-shows in big concerts, but smaller ones can’t, so a clear understanding in the contract is key.)

- Right to Control Event and Eject Troublesome Persons: This clause reserves the venue’s management rights during the event. It should state that venue management and security have the final say on matters of safety and order – including ejecting or refusing entry to individuals for valid reasons (i.e., if someone is violent, extremely intoxicated, etc.), and even stopping the event if there’s an immediate danger to the crowd or venue. While you hope never to invoke it, having this authority explicitly is helpful. It reminds the promoter that ultimately the venue is in charge of venue-related decisions. Some promoters might try to override security to let in an extra 50 people or keep the show going after a curfew – your contract having this clause backs up your on-site call to say “no.”

- Use of Venue / Branding: Include any restrictions on how the promoter can use the venue’s name or imagery in marketing. For example, you might require that any advertising or materials using your venue name/logo be approved by you. This prevents scenarios like a promoter using your venue’s brand in a way you don’t like or implying sponsorship. It also lets you review their marketing for accuracy – ensuring they’re not making wild claims like “#1 venue in the country” or promising “special guests TBA” that you know aren’t real. In the same vein, clarify if they’re allowed to hang banners or do signage at the venue – and any policies about postering (some venues don’t allow external signage without approval). These seem like small details, but they can matter for your venue’s image and relations. A real example: a theater once found a promoter’s flyer claimed the event was “presented by [Theater Name]” which was not true – that misled the public and put the theater’s reputation on the line for an outside show. After that, they added strict language about how their name could be used.

- Settlement and Audit Rights: If your deal involves a share of revenue (tickets, bar, etc.), outline how the settlement will happen. For ticketed events, it’s wise to conduct settlement night-of-show or next business day while everything is fresh. State that you have the right to audit ticket sales or request an accounting of revenue and expenses if it’s a co-promotion deal. In rental situations it might be simpler (flat fee), but for more complex profit-shares, having a clause that allows you to review the promoter’s books related to the event can protect against underreporting. Larger venues even put time frames (e.g., “Venue may audit within 30 days post-event, and promoter must provide supporting documentation”). The idea is to keep everyone honest.

Many of these clauses are standard, but don’t assume a generic contract covers them – always double-check. It can be helpful to reference industry best practices; for instance, the IAVM (International Association of Venue Managers) and INTIX often stress thorough contracts in their guidance. If you’re new to writing such agreements, consulting an entertainment attorney or using a vetted template is worth the cost. As one venue GM quipped, “Our contract is nine pages long, because it’s written in the blood of lessons learned.” Every clause exists because at some point, a scenario happened that showed why it was needed.

When both you and the promoter sign off on a comprehensive contract, you’re not just protected – you’re also aligned. There should be no ambiguity about who handles what, how money flows, or what happens if plans change. This clarity builds trust. In fact, serious promoters will often appreciate a thorough contract because it protects them as well and ensures they know what they’re getting. It’s the shady or sloppy operators that complain a contract is “too much paperwork.” If someone pushes back on reasonable terms like insurance or damages, that’s a huge warning sign. Trust your gut: a client who resists basic protective clauses is likely expecting to skirt their responsibilities. You’re better off without that business.

Red Flags: Warning Signs and When to Walk Away

Even with all these checks, sometimes you’ll encounter situations where something just doesn’t feel right. Seasoned venue operators say that part of vetting is also learning to listen to your instincts. Here are some common red flags that should give you pause – or prompt you to require extra guarantees – if you see them during the vetting process:

- Evasiveness or Inconsistencies: If a promoter can’t give straight answers about past events, or their story keeps changing (one day they claim an artist is confirmed, the next day it’s “almost confirmed”), be cautious. Reliable partners are transparent and consistent. Evasiveness about details like budgets, ticket sales so far, or who exactly is on their team could signal they’re hiding weaknesses or are disorganized.

- No Web Presence or Professional Email: In 2026, even grassroots promoters have some digital footprint. If you can’t find any evidence of their existence beyond a Gmail address and a name, that’s suspect. Similarly, if all communications come from a personal email and they have no company domain or social pages, verify their identity and credibility thoroughly. It could be a newbie, or it could be someone who burned their reputation and is operating under the radar.

- Pressure for a Quick Commitment: Be wary if an outside event client is rushing you to sign a deal without giving you time to do due diligence. High-pressure tactics (“I need an answer by tomorrow or the deal’s off”) are a classic warning sign in business deals. Respectable promoters plan ahead and understand you need internal approval or checks. They won’t bully you into a hasty decision. This is especially true if they dangle a very lucrative opportunity but demand you skip normal procedures – don’t bite. As the saying goes, if it sounds too good to be true, it probably is.

- Reluctance to Sign Contract or Provide Insurance/Deposits: If at contract stage the client starts objecting to fairly standard clauses, or they delay providing the deposit or insurance paperwork, treat that as a red flag. Sometimes a promoter who doesn’t actually have the money will stall (“the wire is coming next week”) – don’t allow an event to stay on sale or keep your date blocked if the promoter misses payment deadlines. Enforce those terms. A legitimate operator will have no issue wiring a deposit on time and sending over a certificate of insurance; any foot-dragging here indicates potential trouble. Remember, trust is earned by action, not just words.

- Overpromising / Lack of Realistic Plan: Pay attention if a promoter promises the moon but can’t back it up. For example, if a relatively unknown promoter claims they will sell 5,000 tickets because “this event will go viral on TikTok,” take a hard look at their marketing plan. Are they investing in real promotion or just hoping for a miracle? Unrealistic attendance projections, especially when paired with minimal marketing spend, are a bad sign. Experienced operators have a sense of what is plausible in their market – if someone wildly overestimates, you might be dealing with either inexperience or dishonesty. You can request more details or a marketing plan to gauge seriousness. No plan = likely no success.

- Deflecting Responsibility: Early conversations can reveal a lot about attitude. If you hear things like “Don’t worry, we’ll figure that out later” or “I usually just trust that the venue will handle those things,” that indicates the person hasn’t fully thought through the event. It’s not your job to educate a promoter on how to do their job (unless you decide to take on a mentorship role deliberately). The best partners come prepared and own their responsibilities. If someone is already trying to push tasks back onto you that weren’t in your scope, it might foreshadow conflict. For instance, a private event client might assume your staff will decorate the space because they didn’t plan setup help – you want to catch that misunderstanding well in advance.

- Bad Reputation or Legal Troubles: This might seem obvious, but it’s worth stating: if your digging unearths serious negative information – lawsuits from past venues, unpaid vendors complaining online, or even criminal charges related to fraud – it’s almost certainly not worth the risk to proceed. While people can change, you don’t want your venue to be the experiment. Financial troubles are also a concern; if you find news of a promoter declaring bankruptcy last year or routinely canceling tours, steer clear or at minimum demand full payment upfront. In the live events world, where there’s smoke, there’s usually fire.

If one or more of these red flags come up, consider walking away or insisting on extra protections (like 100% payment up front, higher deposit, or a probationary trial event). It’s always tough to turn down business, especially if you have an empty date to fill, but think long-term. One disastrous event can cost more than it would have earned you. As a venue operator, maintaining your venue’s quality, safety, and financial stability is priority one.

On the flip side, remember the goal isn’t to exclude every new or small promoter – it’s to manage risk appropriately. You can mitigate some risks rather than outright refuse. For example, if a promising but green promoter has no references, you might still give them a chance with conditions (small off-peak date, higher deposit, lots of guidance from your team). Some of the best long-term promoter relationships start with a venue taking a cautiously managed chance on a newcomer who then proves themselves. One success story involved a new indie promoter who had never done a show above 300 capacity. A veteran venue agreed to let them try a 500-cap show on a Thursday night, but closely mentored them through the process – the promoter was humble, took the advice, and delivered a decent turnout. That same promoter is now a regular booking partner, bringing great niche artists to that venue every quarter. The difference was willingness to follow the venue’s policies and learn. So, if a newbie checks out in character (honest, responsive, insured, and financially sound), a venue can proceed with a bit of faith and a safety net. It’s all about informed trust.

Finally, trust your reputation too. Venue managers often have to answer to owners, boards, or their community. If an event proposal gives you a bad gut feeling or would reflect poorly on your venue’s brand, you’re well within your rights to decline. Whether it’s a misaligned event type (e.g. an 18+ hardcore rave at a family-oriented venue) or a promoter who behaves unprofessionally in preliminary meetings, you have the prerogative to say no. In many cases, how a promoter interacts during the vetting process is a microcosm of how they’ll behave during the show. You’re not just vetting an event, you’re vetting a partner. Choose partners that uphold your standards.

Frequently Asked Questions

Why is vetting event promoters important for venues?

Vetting event promoters protects venues from financial loss, unpaid bills, and reputational damage caused by unreliable partners. Rigorous due diligence ensures promoters have the track record to deliver promised crowds and the funds to cover expenses, preventing disasters like empty venues, safety violations, or last-minute cancellations.

How do venue managers verify a promoter’s reputation?

Venue managers verify reputation by requesting a list of past events and independently confirming their success through press coverage or social media. Essential steps include contacting at least two recent venue references to ask about payment history and professionalism, and investigating the promoter’s online footprint for attendee feedback or warning signs.

What is the standard deposit for booking a venue event?

The standard deposit for securing a venue date is typically 50% of the rental fee due upon signing the agreement. Venues generally require the remaining balance 7 to 30 days prior to the event. This upfront investment confirms the promoter’s financial capability and compensates the venue for holding the date.

What insurance requirements should venues set for outside promoters?

Venues should mandate Public Liability Insurance (PLI) or general liability coverage ranging from $1 million for small events to $5 million for large concerts. Promoters must provide a Certificate of Insurance naming the venue as an “additional insured” well before the event to cover claims regarding bodily injury or property damage.

What clauses should be included in a venue rental contract?

Essential venue rental contract clauses include clear payment terms with default consequences, cancellation policies defining refund rules, and mutual indemnification to protect against liability. Agreements must also specify roles for marketing and staffing, force majeure conditions, and the venue’s right to control safety, including ejecting troublesome attendees or stopping unsafe events.

What are common red flags when booking event promoters?

Major red flags include evasiveness about past events, a lack of professional online presence, and high-pressure tactics to sign contracts quickly without due diligence. Venues should also be wary of promoters who resist standard requirements like insurance or deposits, make unrealistic attendance promises without a marketing plan, or have a history of legal disputes.

Who is responsible for security at a rented venue event?

While the promoter typically pays for security costs, the venue ultimately sets the safety standards and staffing ratios to comply with local regulations. Contracts must specify whether the venue provides in-house security or if the promoter hires an approved firm, ensuring all emergency protocols and capacity limits are strictly enforced.

How can venues safely book inexperienced promoters?

Venues can safely book new promoters by testing them on off-peak nights or smaller rooms before offering prime weekend slots. To mitigate risk, operators should require 100% payment upfront, insist on strict adherence to safety policies, and offer mentorship on production and marketing to help build a successful long-term partnership.